Transforming the Insurance Ecosystem with Cognitive RPA

Posted originally as a whitepaper in 2020 by Shradhanjali Agarwal and Srivatsan Parthasarathy

Introduction

The emerging social first insurers like Lemonade have already attracted most of the younger customer base, Gen Y and Gen Z, by offering quick insurance solutions. Their algorithms are smart enough to analyze vast amounts of data, where they promise to deliver claims in just 3 minutes. This is a far cry from the traditional insurers, as filing insurance claims are mostly manual, drawn out, and involves stressful phone calls. They face immense pressure from pure-play digital players and struggle to keep pace with on-time demand. For insurers, the future is right now and here, but only a few are prepared for the endless possibilities that it presents. One of the main reasons why traditional insurers are unable to keep pace with demand is that they are loaded with repetitive operational tasks in processes, such as underwriting, claims processing, policy servicing, and so on. These processes involve data gathering, entering the data into disparate systems, and data validation.

In any enterprise, only 20% of its data are structured and are easy to process, whereas 80% of the data are either semi structured or unstructured and difficult to process.

Manually processing the data and performing repetitive tasks is time-consuming and leads to increased customer wait times. This challenge often leads to inconsistencies and errors in data, increased costs, and reduced customer satisfaction. Also, with semi and unstructured data in all the processes, it becomes difficult for insurers to streamline and operationalize existing processes. To sustain, improve market share, and grow, it becomes essential for insurers of every quadrant to ensure fast and accurate operational delivery through advanced automation.

The Age of RPA

RPA is a type of automation technology that can be programmed to perform repetitive business tasks. As Gartner defines, RPA is a productivity tool that can be used to mimic or emulate selected tasks (transaction steps) within an overall business or IT process. They pass data to and from different applications, trigger responses, and communicate with multiple systems (including legacy systems) to perform varied repetitive tasks. The insurance industry is a prime candidate for the implementation of RPA, as it is heavily dependent on document-driven business processes. Insurance industry workers spend more than half of their time in collecting and processing data on any given day; tasks that are ideal for automation using RPA. In a typical claims processing scenario, receiving, validating, and approving a claim takes several days. It takes even longer, if there has been an oversight, such as incorrect customer details or mismatched financial data.

RPA can help automate tasks, reduce operational risks, and lessen the workload by 20–30% at an enterprise level.

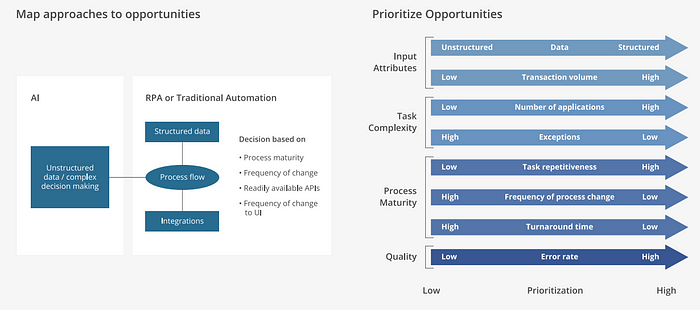

Early adopters of RPA are witnessing immense efficiency and productivity gains across the spectrum of processes — claims processing, new business and underwriting, process analytics, regulatory compliance, and so on. While RPA reduces human intervention for repetitive tasks, it is equally important to understand data formats and document processing opportunities through advanced automation, which requires no human intervention. Processes that involve readily accessible structured content (like spreadsheets, CSV files, and predefined databases) can be automated using RPA, inclusive of UI-level screen-scraping and API interactions.

For processes that involve semi-structured and unstructured content formats (like images, emails, videos, documents in different formats, and so on), the need of the hour is cognitive RPA. It combines the power of RPA with rules engines, AI, and ML to transform data into accessible formats.

First generation RPA focuses mainly on structured data, where data extraction is straightforward and it usually results in just 30%-40% Straight Through Processing (STP) and ultimately human intervention is higher.

In an effort to bring structure to unstructured data, enterprises turn to cognitive RPA, where there is an increase in STP of more than 70%

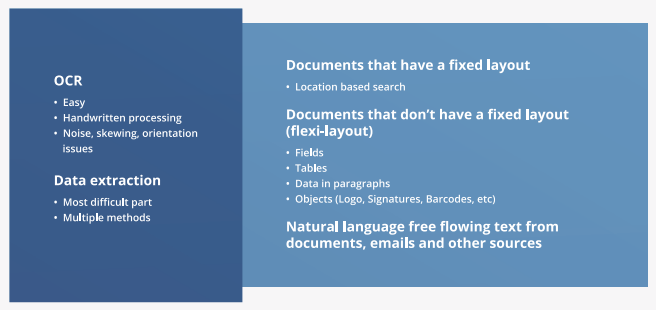

RPA use cases are content-dependent and in cognitive RPA models, the idea is to make the RPA bots learn from human behavior. For this to happen, technologies, like optical character recognition (OCR), Natural language Processing (NLP), document extraction tools, ML, or a combination of these capabilities, are leveraged to automate the unstructured and semi-structured data.

The Path to Cognitive RPA

A process that deals with semi or unstructured data will need some degree of cognitive solutions.

Cognitive RPA uses artificial intelligence (AI) techniques to simulate human intelligence and automate complex tasks that require mandatory human intervention.

With advanced self-learning capabilities, it adds a cognitive layer on top of a conventional RPA process. Cognitive RPA enhances efficiency, increases performance, reduces operational risks and response times, and improves customer experience. One of the main reasons to turn to cognitive RPA is that it can automate complex processes, which previously required human intervention. For example, OCR scans complex documents in different formats, different fonts, and then converts data into the required digital formats. An MIT Sloan Management Review (MIT SMR) mentions ‘only one in twenty companies has extensively incorporated AI into its current offerings or processes.’ With cognitive automation technologies, insurers can increase operational efficiencies of labor-intensive and highly time-consuming processes, like policy quotes and servicing.

Here are a couple of cognitive RPA solutions used by insurers:

- Snapsheet: Snapsheet specializes in claims management technology and virtual appraisal solutions for insurance carriers, risk managers, and TPAs. They offer the industry’s first full integration of total loss claims processing and salvage management technology, in partnership with IAA, a leading global marketplace connecting vehicle buyers and sellers. This unique collaboration enables insurers to automate the end-to-end total loss claim process with little or no manual operation. This is done by automating the exchange of information and controlling activities across all the involved parties, including customers, repairers, and salvage companies.

- Tractable: They offer to accelerate claims processing in the auto insurance space through their AI-powered solutions. Tractable helps in assessing vehicle damage in real-time by using image recognition to support triaging and validate repair-cost estimates automatically

The ‘Why, What & When’ of Cognitive RPA

The Why: Benefits

According to a recent research estimation, by 2026, the global cognitive RPA market is expected to reach $3,620.8 million, growing rapidly at the CAGR of 60.9%. As cognitive RPA is capable of automating unstructured data, insurers can achieve end-to-end automation that delivers critical benefits.

- Increased efficiencies: A human-like interpretation of content from structured and unstructured data allows for fast and accurate processing, reduced manual errors, improved quality, and accuracy.

- Reduced time to process: With the ability to perform complex tasks, such as extracting decision making data from documents and emails, Cognitive RPA increases the speed to process tasks. Also, 24x7 availability with no downtime equals significant time savings in performing labor-intensive processes.

- Reduced costs: With the advanced capabilities of cognitive RPA, companies can identify business opportunities and address critical process-centric issues in real-time. This results in a high return on investment (ROI) of up to 200% in a very short span of time.

- Increased accuracy: Cognitive RPA can derive meaningful predictions from a vast repository of structured and unstructured data with impeccable accuracy.

- Enhanced productivity: Cognitive RPA reduces errors and frauds, offload complex tasks, and accelerates faster turnaround, resulting in a better experience for internal and external users.

- Reduced employee turnover: As cognitive RPA performs all the tedious, repetitive tasks, employees can focus on more creative and intellectually challenging work. This enables greater job satisfaction and increases the workforce retention rate.

The What: Technologies

The cognitive capabilities in automation are at the peak of an inflated expectation cycle, where it is listed to be the number 1 in the top 10 strategic technology trends for 2020. Nearly 65% of organizations that operate with RPA will implement artificial intelligence in their processes by 2022. Cognitive RPA offers enhanced speed, accuracy, and efficiency, and creates 20 to 30 percent in additional capacity, as employees are freed from automatable tasks to focus on higher-value activities. The challenge for insurers, facing an array of solutions, is to implement at scale and capture the maximum value at the lowest possible risk. With the following technologies, cognitive RPA can automate processes end-to-end without human intervention:

- Natural Language Processing (NLP), a subfield of AI, equips software systems with the ability to read, understand, and obtain meaning from human languages. By leveraging NLP, insurers can provide personalized customer experiences and obtain much-needed insights from several customer interactions. For example, NLP can extract vital information from unstructured text data to improve claims processing, automate the customer onboarding process, help customers choose insurance policies, shift payment dates, and automatically get insurance quotes through chatbot software, and much more. A real-time example is LeO, a virtual insurance agent/ conversational bot. It helps in the automation of administrative tasks, such as scheduling calls and meetings, customer retention, and lead generation by answering queries, 24/7. With the help of LeO, insurers can provide personalized quotes for home and auto insurance in a matter of seconds. LeO can also send payment reminders, policy renewals, push promotions, and much more.

- Optical Character Recognition (OCR) converts images of typed, handwritten, or printed text into machine-encoded text. Here is an example of our client, who is one of the best-rated pet insurance providers in the USA. They provide insurance plans for dogs and cats and cover illnesses, accidents, cancer care, clinical procedures, hospitalization, and so on. They faced difficulties in managing claims reimbursement, as digital copies of medical invoices received from various hospitals and online stores were in different sizes and formats. We came up with a solution to implement an RPA bot, combined with an OCR (Optical Character Recognition) tool. This enabled the complete automation of the data capture and validation process.

- Machine Learning (ML) enables systems with the ability to learn, analyze, and improve from the experiences. ML-based document classification and extraction models can pull data directly from documents, emails, slips, claim forms, medical reports, schedules, risks, and so on. For example, personalized pricing through Machine Learning (ML) is one of the best ways to convert a prospect to a customer. Identifying the individual needs from various data formats, and predicting the right pricing through ML tools and techniques, not only can triage claims faster according to the risk selection, but also identify fraud.

- Deep Learning (DL) has many-layered neural network architecture to extract information from unstructured data. A client of ours, one of the top 10 Insurance brokers in the US, was looking for ways to reduce error rates and improve TAT. Their client-facing teams had huge volumes of work queued up, which was affecting the forward business flow. The business strategy they adopted to resolve this issue was to offload all processing to a Service Center (SC). The solution we implemented was high-performance workflow automation that enabled the SC teams to scale according to the business needs, with a response time of less than 5 seconds.

- Process visualization and analytics — Process automation goes hand in hand with process visibility. To ensure that automation is working as expected, business stakeholders need to be equipped with dashboards that indicate the health of the process, transaction volumes, the activity of the bots, and the efficiency of the ML components. These dashboards ensure that any exceptions are addressed on time, without leading to escalations. Further, analytics on this information can help identify the next set of opportunities for automation

The When: Need for Cognitive RPA

The insurance industry operates on input from multiple stakeholders and every day, there is an increase in the amount of data being generated. As the data increases, it becomes difficult to operationalize existing processes. To process high volume and high complexity tasks, cognitive RPA is required.

Cognitive RPA achieves a 70–80% straight-through processing rate with technologies like natural language processing (NLP), optical character recognition (OCR), machine learning (ML), deep learning (DL), process visualization, and analytics. Cognitive RPA processes unstructured data, recognizes patterns, predicts the categories, and performs the next course of action.

The below list mentions the scenarios where insurers need to implement cognitive RPA:

- Processing of unstructured data

- Management of non-standard documents

- Performing complex decision rules

- Automation based on interaction with disparate system

The Shift to Automating Unstructured Data

As insurers increase their customer base at a rapid pace, the volume of data is also increasing at an exponential rate. Whether it is the KYC process, claim form fill up, policy issuance, risk assessment or claim settlement in P&C, life, auto or health insurance, the inflow of data across all functions and lines of insurance is continuous.

What do insurers do with all of this data? Often they store data for compliance and regulatory requirements, without realizing their hidden value. This inability to efficiently deal with a surfeit of data leads to a ripple effect in insurance:

- Data extraction from various unstructured and structured sources is manual and, thus, highly inefficient.

- Lack of granular analysis of available data leads to high error rates, duplication, omissions, delays, and inaccuracies in insurance functions.

- As a result, customer satisfaction takes a big setback.

- Clients turn to market alternatives, and insurers lose business and relevance.

Recent research shows that between 50% to 75% of enterprise data is unstructured and generally inaccessible to enterprise systems. Most organizations source, collate, and preserve a lot of information assets created during various business activities, only for compliance purposes. Further, unstructured and semi-structured data can come from various sources, such as emails, texts, logs, documents, audio, video, images, invoices, purchase orders, mortgage applications, and so on.

To process semi-structured and unstructured content formats, cognitive RPA becomes imperative, as it requires rules engines, artificial intelligence (AI) and machine learning (ML) to transform data into accessible formats.

Now, it is important for enterprises to map and prioritize automation opportunities, so that they can get the best out of their data.

Cognitive RPA Framework

The major challenge in automating data extraction is due to the presence of voluminous unstructured data (or dark data). We recommend a four-step process to extract insight from both structured and unstructured data. The steps are:

Here is a typical automation flow that uses Intelligent Data Processing (IDP):

The success rate of unstructured data extraction depends on how the content/document processing funnel is designed. Here is our tried and tested approach:

The absolute Imperative: Robotics Operations Center

Automation is not something that you can set up once and expect it to run forever. Factors like process changes, interfaced application updates, security patches applied to one or more software applications that come within the purview of the automation process can impact the bots and involve human intervention.

Most of the insurers fail at the bot maintenance stage, as bot monitoring is more of an afterthought than a meticulously thought out strategy. It is important for large enterprises to start thinking about Robotic Operations Center (ROC) from day one, so that when they hit 50+ bots, they do not crash and burn.

Devising a strategy for bot maintenance and governance ahead in the bot development lifecycle will allow to successfully execute effective bot maintenance, irrespective of the scale of the initiative; even with 500+ bots.

Typically, in large enterprises, bot production happens in Automation Factories, and maintenance happens in ROCs. The main advantage of having an automation factory is that it will be able to provide automation across organizations, with better quality, reduced cost, fewer implications, and at a faster rate. Bots developed in the automation factories move to ROC, when they are in the production stage.

Before the ROC Command Center takes over the bot maintenance, the teams must go through the following process:

ROC handover and bot in-take process: Each step in the bot handover process involves two or more teams. In a typical enterprise, multiple parties will be involved in the bot in-take process:

- The development team, who has developed the bot

- The ROC team, who performs the bot maintenance

- The Infrastructure support team, who takes care of the servers and upgrades for the bot machines

- The business stakeholders

- The stakeholders of the applications that are integrated with the bots All these parties have to be involved in the handover process for a successful transition. For a smooth handover, the ROC team will have to be involved at least from the UAT phase

Preventing RPA disaster with bot monitoring and maintenance

When bots come to ROC, it becomes important to maintain control of the automation activities to proactively recognize gaps, address all possible conflicts, and overcome potential downtime. ROC takes up this responsibility, through multiple bot hypercare activities by setting up these processes:

- Incident management process describes how incidents need to be managed at various levels of support. When the ROC team takes over the bot maintenance, every request to the ROC team needs to be routed via a ticketing system. It is important to monitor and record all conversations that occur in an incident, so that process improvements can be done to the bot, as well as the maintenance teams.

- Problem management process describes how to handle incidents that unfold as problems. When an incident is determined to be a problem that needs to be analyzed further, it follows the problem management process to find a resolution. This can be as simple as interfacing with an application owner to get the password reset or it can be a change in the process, which will need development support and has to go through the entire Software Development Lifecycle. In any case, constant communication to the stakeholders involved is key to the success of the ROC team’s effectiveness.

- ROC governance provides a framework for all the activities that happen in a ROC setup. From daily interactions of the ROC team to the quarterly reporting, it is important for the business to keep a finger on the pulse of the bots and make strategic decisions, when it comes to process improvements

All these processes target to improve the efficiency of the ROC team, which effectively prevents RPA disasters. Bots need constant monitoring and maintenance throughout their lifecycle. It is recommended to have a good understanding of all the processes that happen in a ROC.

Reimagining Insurance with Cognitive RPA

A PwC survey states that 70% of today’s global insurance CEOs want operational efficiencies to drive growth. Insurers have understood the wide possibilities of cognitive RPA, which could increase efficiency gains and transform the insurance value chain. By becoming more resilient in their process, insurance leaders can pivot their current and future moves. Insurers must act today to sustain and grow; they need to reassess their operating model and implement significant changes to move ahead.

With a seamless claims process, insurance leaders can improve customer experiences and drive business growth with operational efficiency.

Processes that are data-intensive, complex, and require judgement-based decisions are more suitable for cognitive automation. The following list acts as a reference to reconfigure the insurance industry operating model and automate activities across the entire value chain:

Conclusion

The reason for an automation implementation strategy could range from reducing costs and errors to improving process efficiency, or it could be a part of your digitization efforts. Whatever the reasons may be, here is a checklist that can help identify the right strategy to reap high ROI:

- Select the right automation tool(s)

- Choose the vendor(s)

- Make sure you have procured the right licenses (from RPA tool vendors or any other cognitive/auxiliary tool licenses)

- Do a Proof of Concept

- Conduct a pilot program

- Set up a Center of Excellence

- Set up a governance framework

- Ensure that infrastructure readiness assessment is done

- Set up 24/7 Operations Center for bot process maintenance